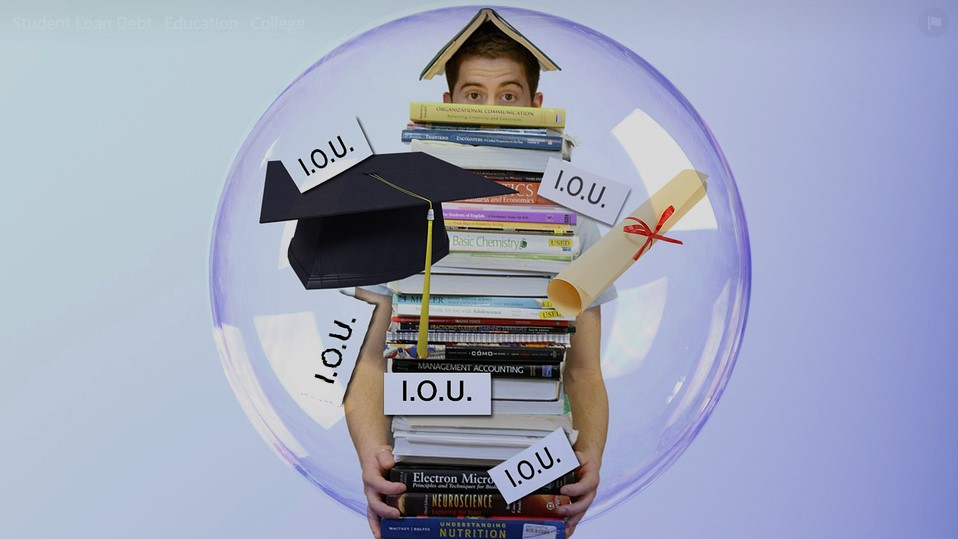

Don’t Drown in Student Debt: 4 Tips to Free Your Finances

Student loan debt feels like an unfortunate part of life. There are, however, ways to keep this debt from crushing you. Below are a few tips that can allow you to free your finances and avoiding drowning in debt.

Work with the Financial Office

Perhaps the best way to avoid drowning in student debt is to minimize the debt that you take out in the first place. There are almost certainly grants and programs for which you qualify, but most of them seem frustratingly hidden to the average student. If you want to avoid taking out more loans, talk to someone at your school’s financial aid office. Doing so will give you access to a number of different programs that your school offers and might significantly reduce your debt burden.

Apply for Scholarships

If you can’t afford to pay for school and you don’t want to take out loans, the most obvious solution is to apply for scholarships. Don’t worry about whether or not you’re necessarily the ideal candidate for a given scholarship – the goal is to apply for as many as you can. There are plenty of small and obscure scholarships for which few apply, so you might stand a much better chance of receiving an award than you imagine. For scholarships that require submissions of essays and other skilled work, making the effort may well pay off, as you never know who your competition really is for any given round.

Work with a Debt Settlement Company

If you’re already out of school and dealing with debt, you may want to look into working with a debt settlement company in order to ensure that you can make your payments in a timely manner. These programs vary significantly, but most will help you to find a way to make payments without destroying your credit or putting you at risk of having your wages garnished.

Work During the Summer

It’s also a good idea to work more during the summer, especially if you’ve already taken out loans. While it’s incredibly difficult to earn enough during a summer to pay for school, you can use some of the extra hours that you’ve logged during the summer months to pay down your debt. Student loans are often much easier to manage if you can stay on top of the interest while you are still in school.

The best way to avoid getting into student debt is to seek out programs that will give you money in lieu of taking out loans. If this fails, try to keep your payments down by paying off the interest and look for help from a debt settlement organization if you can’t keep up with the payments. Loan debt is tough to deal with, but you can minimize the difficulty by making a few key choices.